Step 7: Get The Full Roadmap To Success

Up next: how to run a successful onboarding program

Get a step-by-step guide on onboarding, compliance, and more with our NEW Roadmap to Success eBook, available free now.

Read it free now

When you launch embedded or integrated payment features, you are launching new functionality and features that complement (or make up part of) your core offerings. The best way to think about launching your payment features is like marketing a new feature within your existing platform. Like all features, to make it compelling and drive conversions you need to think about it from your target audience’s perspective first.

This in-depth excerpt from Part 2: Generating Adoption, The Roadmap to Success eBook gives you easy, actionable steps on how to identify the key benefits that will generate impact with your target market, creating your campaign assets, and balancing local compliance regulations for a successful launch campaign. At the end of this article, you will have the framework (and bonus examples) you need to create your own impactful campaign and generate adoption of your new payment features.

If you want the full guide, including actionable steps for managing local compliance, onboarding merchants, doing BETA testing and more, you can download it free here.

Like all new features, to make it compelling and drive conversions you need to think about it from your target audience’s perspective first.

Embedded payments is fast gaining traction in the local APAC market, and is quickly becoming the new frontier for elevated customer experiences and value creation within software platforms. Further, as the rate of digital payments has increased, the demand on businesses to provide more payment options has grown. The shift towards a cashless economy has also introduced opportunities to create operational efficiencies that can reduce manual reconciliation, decrease fraud, and improve access and insights into crucial payment data.

This, combined with the need to meet client demand for an omnichannel experience, has created demand for in-platform payment solutions that software companies can use to deliver a better customer experience and grow a new revenue stream.

As part of planning the launch of integrated payments on your platform, you need to think about the specific challenges it will solve for your clients. For vertical software providers, your customers could range in size from sole contractors to large enterprise organisations.

While all your customers likely exist within a specific vertical, their pain points may differ based on the size and maturity of their business. To identify what payment features are going to have the most impact and value to your clients, you need to answer the following questions:

For example, a field service software platform that integrates payments may do so because it can solve industry-specific problems for its customers. These problems may include:

Using the questions and example outlined above, segment your customer base and talk with them to identify the key payment challenges they face and how this impacts their businesses. You’re going to need this information to get maximum impact and traction with your launch campaign.

Whilst some benefits of integrated or embedded payments are universal, such as streamlining cash flow, faster payment times and simplifying your customer’s tech stack, there are other benefits that are specific to your industry vertical. Identifying these benefits and understanding how to communicate them is critical in getting uptake of your new payment features.

Some of the common features and benefits of in-platform payments are outlined below. These features and benefits can be used to steer the direction of your marketing campaign and launch. Pick 2-3 to focus on in your launch campaign.

| Pain Point | Feature | Benefit |

|---|---|---|

| Unpredictable cash flow and/or a high churn rate | Recurring payments | Boost cash flow and reduce customer churn by setting up recurring payment schedules from within your <company name> platform. |

| Unsure which products or services are performing best | Reporting | See exactly which products and services are driving revenue growth with the help of your transaction data. |

| Manual reconciliation and reporting are time-consuming | Automated reconciliation | Experience time savings and reduce manual data entry errors with automated reconciliation across all payment channels. |

| Fragmented solutions used to run a business | In-platform features | Streamline your business operations by managing your daily payment tasks from within your <company name> platform. |

| Failed payments causing revenue loss | Payment automation | Reduce failed payments with automatic reattempt features. |

| Security and data concerns | Data tokenization and add-on features | Rest assured your customers data is secure and cannot be accessed or shared with built-in tokenization features. Plus, with access to optional extras such as fraud protection with 3D-Secure 2 (3DS2) you can further protect your business and reduce the rate of chargebacks and fraud. |

| Lack of visibility over payments and cash flow | Reporting and analytics | Get better visibility over your business cash flow with access to payment insights via our pre-built reporting dashboard and pipeline features. |

| Current payment option has high fees | Competitive rates | Reduce payment fees with our competitive rates for <failed payments, chargeback processing, credit card processing, direct debit>. Our fees start from $X.XX and X.XX% per credit card transaction. |

| Pain Point | Feature | Benefit |

|---|---|---|

| Payments aren’t aligned with product or service delivery | Split payments | Split your payment into an upfront deposit and future scheduled payment that will automatically deduct after the field service job is completed. |

| Slow invoice payments | Payment options | Get paid faster with the ability to offer a ‘Pay now’ button on all invoices, that will direct to a checkout page with a range of payment options. |

| Late rental payments | Direct debit automation | Ensure tenants pay their rent on time with the ability to set up automated direct debit payments from within your <company name> platform. |

| Declined gym membership payments | Direct debit options | Reduce declined payments with direct debit payment options so your customers never miss a membership payment due to an expired credit card again. |

| Tight cash flow in practice settings | Flexible payment options | Get paid faster and easier with more payment options available. We accept Visa, Mastercard, AMEX, Direct Debit, BPAY, Apple Pay, and Google Pay. |

Once you have identified your audience’s pain points and the features and benefits that your payments feature will bring to businesses, it’s time to launch your marketing campaign. Your campaign should target existing customers, external stakeholders, and suitable commercial partners. The channels and messaging you use for each audience will differ slightly to ensure you communicate how in-platform payments will resolve their unique challenges.

Your existing customers are used to receiving notifications and communications within your platform or via their chosen channels, such as email. Using the pain points, features and benefits table outlined above for your key messages, create marketing collateral to publish via:

New potential customers may not know as much about your company and its products, so establishing trust is critical. Your messaging to this audience can be based on the pain points, features and benefits table, perhaps with the added social proof of reviews and testimonials. The channels you should use for marketing to external stakeholders include:

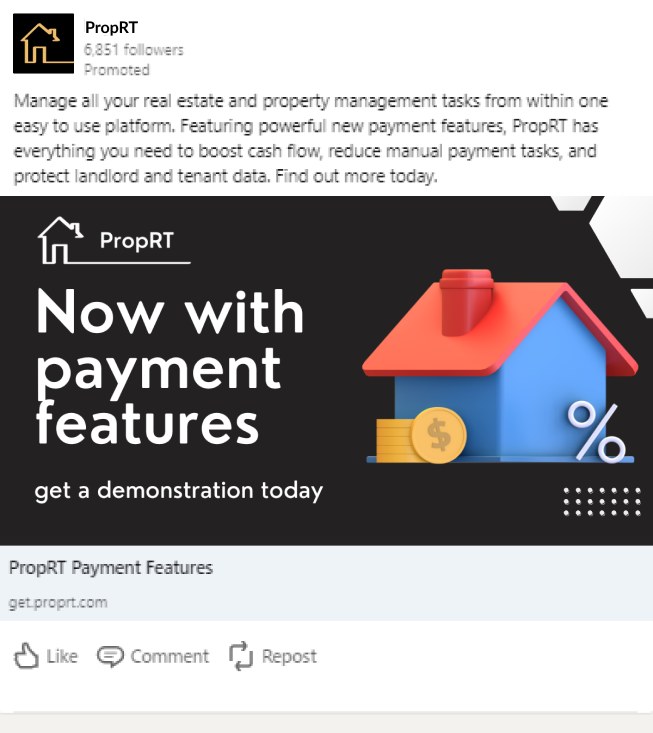

Here are some examples of marketing materials you may produce for your existing customers using an example client called PropRT (a fictional property management platform).

When creating your launch email, take 2-3 pain points and benefits and weave them into your messaging. Don’t put any specific pricing or go too into detail with your messaging (see below about anti-hawking provisions). Link to a web page or brochure with more information, and make sure to include your AFSL (or your partner’s one) in the disclaimers.

Your software interface is a great place to call out your new features, as it is where your users interact and establish value with your brand the most. Aside from the navigation menu, consider calling out your new features on your home page, dashboard, or within other appropriate places in your platform.

Your landing page is the place where you can really explain your new features in depth, and share some of your pricing. To make it as effective as possible, including some contact details or a form so your users who are interested in learning more can get in contact with you.

Social media is likely to target both your new and existing customers, so make sure to link out to a landing page or brochure where they can find more information.

Your website is another great place to create awareness of your new payment features. You will need to link to either a contact form or a landing page for people who are interested. Also keep in mind that flashing, unusual or animated banners can sometimes look like spam, so take care to make sure your banner reflects the look and feel of your brand by using the same fonts and imagery as you do across the website.

There are specific things you can and can’t include when you’re marketing your payments feature to ensure its compliant with the relevant legislation. In Australia, unless you are a payment facilitator or authorized representative, you cannot engage potential merchants with specific financial advice or pricing. This means your marketing for in-platform payments needs to comply with Financial Service Law and the hawking provision in s992A and 992AA of the Corporations Act.

Whilst this may seem daunting, the provisions are mostly centered around not contacting your customer unsolicited to talk about financial services, and making sure the content you create around your payment features is accurate and not misleading. If you are working with an embedded/integrated payments provider like Payrix, we will help guide you through this process and handle some of your compliance obligations.

No that you have begun to understand your market from the perspective of payments, identified your users pain points, communicated the benefits of your solution, and turned them into compliant, branded campaign assets, you are ready to take your campaign to your existing customers (and potential new ones) via your digital channels!

Some key things to remember when launching include:

Get a step-by-step guide on onboarding, compliance, and more with our NEW Roadmap to Success eBook, available free now.

Read it free now