The true cost and revenue potential of payment facilitation

What is the revenue potential of payment facilitation?

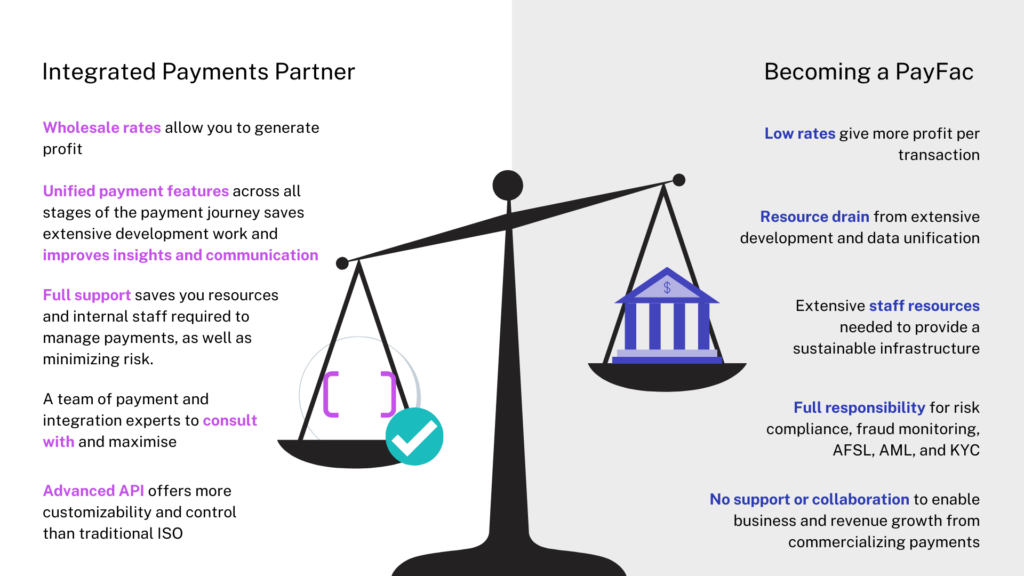

Many companies who want to become a payment facilitator are focussed on monetising their payments. It’s this revenue potential, paired with more control and customization, that often drives the decision to become a payment facilitator.

It’s true that by becoming a payment facilitator you can generate more profit (or basis points), per transaction. As a payfac you are generating a higher profit margin per transaction than, say, if you partnered with an integrated payments provider. Over time, and with large processing quantities, the revenue generated from monetising payments can far outweigh the revenue coming from other streams, like the sales of your software. Shopify, for example, makes more money from monetising their payments than they do from software sales.

What most software companies don’t realise, though, is the true cost and resources required to become a payment facilitator.

Building your own payment gateway, managing your risk and compliance, and implementing an internal payments team (yes, you will need one) quickly racks up costs for your company. This can very quickly drain resources for smaller to medium sized software companies, and can rapidly become unsustainable.

With this in mind, the true cost/benefit of becoming a payment facilitator is not as clear cut as it seems.

So what now?

Sacrificing revenue for ease with a referral partner model

Historically, smaller to medium sized companies who didn’t want to absorb the costs and resource drain of becoming a payfac would turn to a referral payments provider, and utilise their expertise and pre-built technology to integrate a payments solution into their business. These referral partners were mostly one-stop-shops with high penalty and dishonour fees, limited recurring payment capabilities, and only a few payment types accepted. They also charged retail transaction fees, meaning you either had to absorb the costs for your customers, or pass them on. Goodbye to monetising payments.

Choosing an integrated payments partner that won’t destroy your ROI

Luckily, there is a newer solution in the market that offers the best of both worlds in terms of generating a ROI.

More advanced payment integration solutions (like Payrix Integrated) offer all the benefits of an fully supported solution, plus the advantages of wholesale transaction rates, lower penalty fees, and more customization.

So how does it add up?

You save on resources.

By utilising a risk management and compliance partner like Payrix, you can outsource your fraud monitoring and client management, alleviating the extensive costs associated with training or hiring a payments team.

You get more profit per transaction.

The wholesale transaction rates offered by companies like us mean that you get more basis points per transaction than you do at retail rates. They may be slightly higher than the bank offers, but the benefits of outsourcing still far outweigh the costs of going it alone.

You have more ways to get paid.

Stronger APIs and a team of in-house payment software experts mean you get better customization, can easily set up advanced features like recurring payments, and have the ability to accept more payment types. All which feed nicely into your bottom line.