FREE MERCHANT RESOURCES

A Deep Dive Into The True Cost of Fraud for Merchants

Fraud is a constant threat to your merchants’ business and is continuously evolving in terms of breadth and sophistication. Our global experience, knowledge and tools can help you limit the cost of fraud to your platform and your merchants’ businesses.

This comprehensive article covers some of the largest costs associated with fraud, including:

The Hidden Costs of Fraud

Understanding the true cost of fraud is an essential first step in protecting yourself and your merchants. Oversimplifying the cost of fraud can prevent you from accurately identifying the root-causes and preventative measures required to reduce it.

The cost of fraud is not simply the face-value of the fraudulent transaction. The additional costs of chargeback fees, compliance infrastructure, manual intervention, support teams and other costs, act to amplify the transactional cost of fraud. Latest industry estimates are that every $1 of fraud represents a true cost to the merchant of approximately $3.60 [1].

Beyond these more tangible costs, there are hidden costs you and your merchants may also incur. As a result of the prevention tools developed to combat the growing fraud environment, elements like false declines, customer complaints, brand damage and cost of support teams all add to, what seems to be, an ever increasing cost of fraud.

As a contemporary SaaS company, pulling all the relevant ‘levers’ to minimise fraud and maximise revenue for your merchants is key to your success and will set you apart. If you partner with a PayFac like Payrix, you can access the pre-built fraud detection and prevention structures that we offer, saving you significant time and resources required to build and monitor your own fraud detection solution.

Chargebacks

The most common ‘additional cost’ of fraud is chargebacks. A chargeback is a payment dispute that occurs when a buyer questions the validity of a transaction charged on their credit or debit card and initiates a claim with their bank to reverse the transaction. The Card Not Present (CNP) rules are skewed toward the protection of consumers so Chargeback caused by fraud can turn out to be a costly and time-consuming process for your merchants. When a chargeback is made against a merchant, on top of the face value of the transaction and the lost merchandise, a chargeback fee is also charged to the merchant.

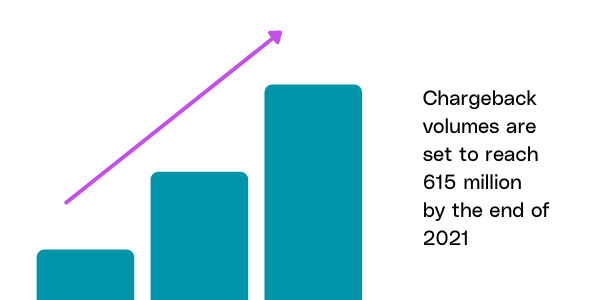

Alarmingly, the rate of chargebacks continues to grow and become more expensive as digital payments continue to rise. Global chargeback volumes are set to reach 615 million by the end 2021, and the cost per chargeback could be as high as $191 by 2023 [3].

Why are chargebacks so expensive?

In a 2021 survey by Kount titled “Digital Payments in 2021: Opportunities and Chargeback Risks” 32% of respondents say a lack of experience with chargeback prevention is their company’s top chargeback challenge [1].

Following this, lack of chargeback prevention strategies, and decreasing the company’s chargeback rate are the two most cited challenges alongside experience.

For SaaS companies that provide payment services to merchants, being able to assist with reducing the impact of chargebacks is an important way to help reduce the cost of fraud. However, navigating this can be complex and timely for SaaS companies as there is a high level of complexity in being able to develop and deploy a solution at scale. In a 2018 industry survey, 62% of SaaS companies cited chargeback and dispute resolution process as a pain point.

To address and reduce the cost of chargeback fraud, it’s critical to understand how to measure the impact and prevalence of chargebacks on your merchants.

Measuring the impact and prevalence of chargebacks

The fundamental indicators that drive the chargeback space are Chargeback rate, Dispute or Representment rate and Win rate.

Chargeback rates

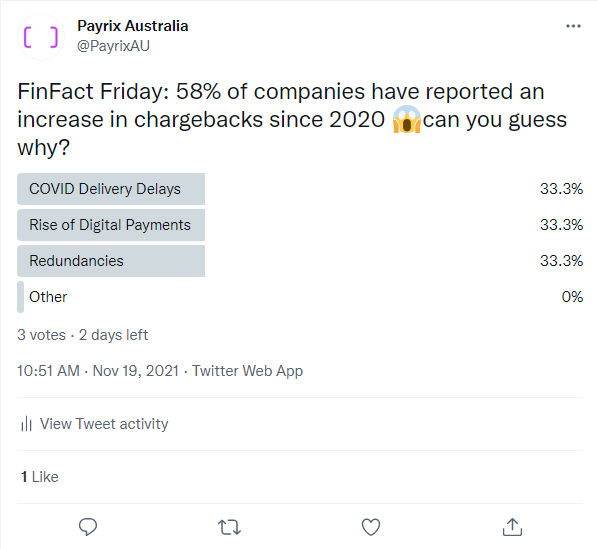

The rate of chargebacks has grown since the onset of the global pandemic. In a recent survey report by Kount titled “Digital Payments in 2021: Opportunities and Chargeback Risks”, 58% of respondents reported their company chargeback rates have increased since March 2020.

In the same study, 47% of respondents estimated their company’s current chargeback rate to be between 0.6%-1%, whereas 33% estimated their company’s current chargeback rate as exceeding 1%.

According to Chargeback Guru’s, below 0.65% is considered a good chargeback rate. Anything above 0.9% could result in penalties from credit card networks [2].

What this shows is that 80% of those surveyed are sitting above what is considered to be a ‘good’ chargeback rate.

how can you lower chargeback rate?

There are generally two main ways for detecting and preventing chargebacks using software:

The Two Main Methods To Detect And Prevent Chargebacks

- Defining rules/parameters, and using a combination of machine learning and manual changes to detect suspicious activity

- 2FA or SCA to ensure the customer identity is valid before the purchase can be made

Each of these have some pro’s and con’s, but generally the second option is the most successful at preventing fraud. Historically, it was also more likely to cause a false decline, but new developments have made this method more successful.

Software integrations like 3DSecure 2.0 require 2FA for customers to make a payment. This added level of security lowers the rate of chargebacks, by preventing fraudsters and bots from making false purchases.

Our payments solution comes pre-built with a 3DSecure integration to help protect our software partners and their clients. We supplement this with internal monitoring processes to help further reduce fraudulent card transactions. This combination of in-person and machine fraud detection helps protect our partners and greatly reduces the likelihood of a chargeback.

It also protects your clients from having to absorb some of the liability and costs of fraud. Any chargebacks that are detected as ‘fraud’ are covered by 3DSecure and do not incur additional costs for the merchant.

Chargeback disputes

The rate at which chargebacks are being disputed by merchants varies depending on the sector they are in or the type of product and service they provide. Eighty percent of companies dispute their chargebacks but their dispute rates are relatively low. 60% of companies dispute only some chargebacks — 5% don’t dispute chargebacks at all.

The two most cited reasons inhibiting higher re-presentment rates are the relatively low win rates coupled with the operational burden of disputing chargebacks. With more than 70% of companies still electing to handle representment in-house, the cost of this operational burden continues to grow and dis-incentivizes companies from disputing in the first place.

Win rates

Without comprehensive training or knowledge of disputing chargebacks, this can be a difficult and costly service for a SaaS company to provide to their merchants. As a payments partner, we take on some of this challenge on your behalf, leveraging our in-house team of risk and payment fraud specialists to help your merchants increase both your re-presentment rate and win rates.

Win rates are the final key metric regarding revenue recovery. A staggering 25% of companies do not calculate or monitor their win rates. Of the companies that do, more than half are only recovering 60% of their revenue. We understand the re-presentment process places a significant burden on your merchants’ operations and distracts them from more important things. By partnering with us, you can help bring additional resources to your merchant’s dispute team and achieve significantly higher win rates.

Managing and reducing the cost of chargebacks

Managing and reducing chargebacks requires a deeper dive into what drives them and how to challenge them. The three key categories of chargeback are Friendly fraud, Criminal fraud and legitimate Merchant error. Chargebacks due to Criminal fraud and legitimate Merchant error are difficult to challenge. Given the current CNP rules, the most pragmatic approach here is to put in place business rules that will mitigate the occurrence of these two categories and prevent them before they happen.

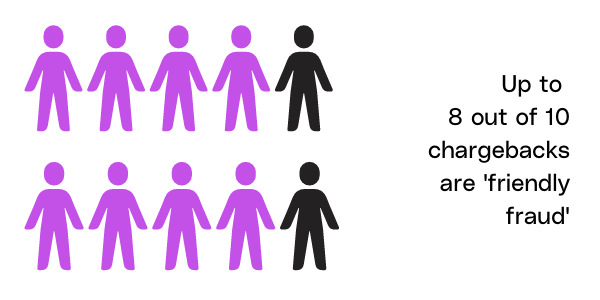

Friendly Fraud

Of the three categories, friendly fraud is by far the biggest. It can account for anywhere up to 80% of a merchant’s chargebacks. Often referred to as First Party fraud, it is the instance where legitimate card holders dispute a transaction and file a claim with their institution that begins the chargeback process. Friendly fraud can be ‘accidental’ or ‘deliberate’, making it more difficult for your merchants to distinguish it from Criminal fraud.

Regardless of the customer’s motivation for filing the claim, merchants can and should fight friendly fraud claims. Malicious Friendly fraud is the equivalent of shoplifting. Industry data estimates that approximately 30% of friendly fraud is malicious, further estimating that in 50% of successfully executed fraud, customers will file another illegitimate chargeback within the next 90 days.

We understand that business owners are incredibly busy and the mere thought of gathering the evidence, writing up an explanation and poring over receipts just to fight a chargeback seems impossible. But letting chargebacks go, particularly when they’re unwarranted can be a serious mistake, especially in the long run. Choosing not to fight an illegitimate chargeback can lead to either significant loss of revenue or loss of reputation that can result in higher processing costs and threaten your merchant account status.

In a Chargeback 911 study, 40% of companies have a target of 0.1% chargeback rate but less than 20% of those companies report achieving that goal. Compounding this problem is the poor win rates. Although 82 percent of organizations are disputing chargebacks, more than one-third of merchants report a win rate of 30 percent or less, and nearly one in five have win rates less than 15 percent. Nearly one-fourth of organizations do not know their win rate.

While 45 percent of organizations are using a third-party provider to prevent fraud, just 21 percent are using a third-party provider to assist with chargeback representation.

As an integrated payments partner, we work with you to decrease your chargeback rate and increase your win rate, significantly reducing your cost of fraud multiplier.

False Declines

False detection of fraud is the largest contributor to costs incurred by merchants. In fact, the cost of false declines are estimated to reach $443 billion USD in 2021, whereas actual incidents of fraud are predicted to cost just a fraction of this [4]. The impact of false declines goes beyond the upfront cost also, with each $1 lost equaling up to $34 in lost sales in the long term [3]. The reward for your merchants is significant if you can help them get the balance right and allow more transactions to proceed.

Allowing more of these legitimate orders to proceed will obviously help your merchants grow their revenue but it also means they will annoy or insult fewer of their customers. A Sapio research study revealed that up to 33% of customers will never make another purchase from a merchant that falsely declines their purchase. Plus, false declines will drive increased customer complaints and customer service calls by phone, email and chat, further expanding the cost of in-house support teams.

Put simply, false declines reduce your merchants’ revenue, annoy your customers, damage brand equity, diminish the customer experience and ultimately increase your cost of customer support.

Solutions like 3DSecure 2.0 have adapted their technology to reduce the likelihood of a false decline automatically, without significant setup or development needed, whereas other programs like Kount may require significant manual setup and monitoring to achieve a healthy chargeback rate, however it does offer more customizability and control over your fraud rules.

The best way to identify what fraud software option suits you is to speak to a payments expert →

Vendor Complexity

A significant hidden cost of fraud is vendor complexity. As the instance of fraud and chargeback escalates, so too does the cost of managing it. Tracking, manual intervention, re-presentment and reporting, all result in either greater support-headcount for your merchants or greater number of vendors, most likely, both.

In a Chargeback 911 survey, more than 50% of their customers employ more than 5 people in their fraud review and prevention teams, with almost 40% of these people primarily involved in the manual intervention process.

With industry averages running at just under 200 apps per company and an average spend of $4.5M per annum, vendor complexity is under the microscope. Our technology stack will enable you to rationalise your vendor portfolio, simplify your reporting capabilities and reduce the true cost of fraud in your business.

Payrix’s partnership with 3DSecure 2.0 allows you to access advanced fraud prevention methods, without any significant manual monitoring or setup on your side.

Balancing Risk and Reward

The breadth, sophistication and success of fraud is increasing and placing significant upward pressure on the incidence of chargebacks. As a result, companies have to deal with an ever-escalating cost of managing, tracking, disputing and reporting on fraudulent activity.

Having the right software, education, resources, and support at various milestones of the user experience will lower a company’s chargeback rate but the balance between preventing fraud and avoiding false declines is critical. It’s important to remember that most chargebacks are classed as ‘friendly fraud’; despite how you structure your fraud detection and prevention solutions, some chargebacks will still occur and a company’s win rate becomes paramount in maximising revenue.

As a SaaS provider, offering a comprehensive payments solution includes being able to support your clients with fraud management and decreasing the impacts of chargebacks, false declines, and vendor complexity. To do this, developing a comprehensive merchant chargeback strategy and integrating fraud prevention technology is paramount.

If you integrate with an embedded payments partner, like Payrix, you can address these requirements and support your merchants without having to build your own solution from scratch, whilst still being able to control your in-platform payments experience. Speak to one of our payments experts today to learn more about our comprehensive risk management and compliance services and how they can seamlessly integrate into your existing software platforms.

Sources:

- Chargeback Gurus, 2020: Maintaining Your Chargeback Ratio

- Chargeback 911, 2020: Chargeback Statistics to Know for 2021 & Beyond

- Merchant Risk Council, 2021: 2021 MRC Global Fraud Survey

- Sapio, 2020: 33% of US consumers drop retailers after a false decline: Here’s what to do