As the software and payments industry continues evolving, it’s no longer a question of if — but when — field service platforms will pivot to a more modern, scalable solution for payments.

Embedded payments are a way of maximizing revenue and staying competitive in your industry. And field services isn’t the only SaaS vertical making the change to platform payments. Other verticals like childcare, fitness, medical, dental, and property management are realizing that gaining more control over their merchant portfolio and customer experience with payments-as-a-service is a win-win for their business.

Powering More Profit for HVAC Businesses

The typical HVAC business relies on revenue from sales and service to run operations, manage headcount, and drive growth. However, these profit drivers alone may not be enough to help a business achieve its true potential.

Perhaps your platform is specifically designed for HVAC businesses and does everything from route management to inventory to CRM — all while processing and reconciling one-time and recurring payments. If you already have payments volume on your platform, you may be finding that these sales just aren’t generating the kind of revenue you need to scale. This is common when outsourcing payments.

In an industry like field services where you’re largely relying on recurring payments, outsourcing payment processing leaves significant revenue on the table. Creating your own payments service for your platform is a way to earn more profit on every

transaction and increase your revenue.

But there’s more to this upgrade than just the nice revenue bump. Choosing the right embedded payments solution empowers you to minimize friction for your customers, be better positioned for retention, and remain competitive in the field services space.

With embedded payments, it’s easier for you to successfully deploy, manage, and deliver recurring payments. Platform payments include coverage of all payments types, card-present and card-not-present, as well as complex billing and fee models — all while delivering a seamless user experience.

Adding payments as a service on your software increases your revenue by 2-3x. It also creates a stickier product, which leads to increasing the total enterprise value (TEV) of your software.

Keep reading for a deep-dive into how monetizing payments works for field service platforms and what you can do to ensure your success with embedded payments.

The ultimate power tool for building revenue

So, what does it mean to transform your platform into a revenue generation machine? Let’s start by explaining a few key terms:

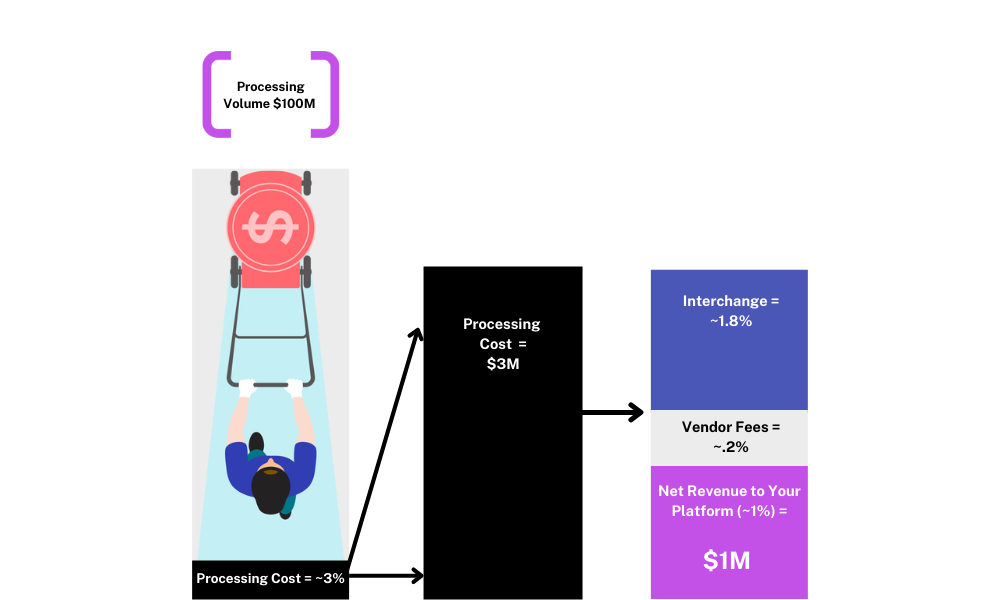

- Volume: The dollar amount of payments you are processing through your software in a given time period (monthly, annual, etc).

- Processing Cost: Cost to process the payments volume running through your platform.

- Vendor Fees: Fees typical companies in the embedded payments space will charge for a solution.

- Interchange: Transaction fees set by the card networks (Visa, Mastercard, American Express, Discover) whenever a customer uses a credit/debit card. These are paid to the card-issuing bank to cover costs for fraud and the risk involved in approving a payment.

- Basis Point: A simplified unit of measure that expresses percentages in finance.

- Net Revenue: The margin to your platform via embedded payments.

Your revenue from embedded payments is the difference between the buy-rate from your payments provider and the go-to-market rate you charge your customer.

For example, let’s say your business is processing $100M in payments on your field services platform. If your processing fees are ~3%, your total processing cost will be about $3M. Going a layer deeper, your processing cost is made up of ~1.8% in interchange fees (which will vary by card brand) and ~.2% in vendor fees paid to your embedded payments partner.

As a platform, you can earn up to 100 basis points (1%) with embedded payments1. So if you are processing $100M in volume on your platform, your net revenue from payments will be around $1M. Embedded payments transform what is purely a cost center in a traditional payments model into bottom-line revenue that can be invested back into your company.

Field Services — Planting the Seeds For Greater Profit

When a cloud-based platform for lawn care, pest control and pool care businesses approached Payix with a vision to enhance their bottom line by helping their field service customers grow quickly, scale intelligently and increase revenue, we knew we had the right solution for the job.

By leveraging Payrix Pro, they were able to achieve their vision in short order all while delivering a superior product and customer experience.

The partner with all the tools you need

Monetizing payments may already sound attractive, but successfully scaling from where you are today to your maximum revenue potential requires a strategic approach. Choosing an embedded payment solution is a step in the right direction, but it’s not the complete formula for success.

Payrix is a disruptor to major payments processing providers, giving you the power to facilitate payments on your platform, become your own payments brand, and get the benefits of becoming a PayFac — without the huge investment and cost.

When you choose Payrix as your partner for enabling embedded payments on your platform, we’ll help you establish a payments roadmap and timeline for integration.

Once you’ve thoroughly scoped how you will enable payments on your platform, you’re ready to develop a monetization strategy to maximize your payments revenue by:

- Charging a percentage transaction fee for payments that are processed through your platform

- Charging a flat fee for payments processed

- Marking up payments as a premium feature or bundle of features

- Including fees for non-traditional payment services (i.e. sign-up, monthly SaaS, funding/payout) in your pricing strategy

- A combination of the above

How you will get your customers to adopt your new solution also plays an integral role in accelerating your time to revenue. To move quickly, you must have a plan in place to generate adoption. Understanding the needs of your field service customers and communicating the benefits of your solution are essential to getting their buy-in.

If you’re working with an embedded payments partner like Payrix, the resources to support your short– and long-term vision will already be in place. Payrix provides an expert team that takes on the heavy lifting of maintaining the technology and managing risk and compliance, so you can focus on growing your business. With an all-in-one solution and guidance at every step of the process, you have everything your platform needs to unleash your possibilities with Payrix.

1Your annual payments revenue opportunity range is estimated based on go-to-market pricing and estimated interchange fees.

See what Payrix can do for your business

If you’re curious about creating your own payments service for field services, now is the perfect time to go a little deeper.

Get started by scheduling time with Payrix to see where you can grow with embedded payments.