Costs Vs Profit – Weighing Up Options For Payments Infrastructure

If you are considering offering PaaS/PaaF (payments as a service, or payments as a feature) within your SaaS platform, then you inevitably will need to weigh up the operational costs and profit potential of your payments model.

There are generally 3 key options if you want to enable payments: becoming a registered payment facilitator, striking up a partnership with an existing PayFac, or setting up a referral model.

Each option has a variety of pros and cons, across customer experience, risk and responsibility, time to go live, and more. They also vary greatly in terms of operational costs, setup costs, and ongoing maintenance.

Option 1: Becoming a Payment Facilitator

The costs involved in becoming a payment facilitator is significant, and may only make sense for your business if you can justify the costs with significant revenue being generated from processing large volumes of payments through your platform.

At a high level, the costs of becoming a payment facilitator often look similar to the below:

This doesn’t include the costs of licensing, legal fees, consultants, and any other support you may need. To get a full idea of the potential costs associated, it’s a good idea to speak to a payments expert.

In terms of profit, however, the payment facilitator model gives you the full % share per transaction.

This means that with enough volume, you will be able to generate a profit from becoming a payment facilitator, however most SaaS companies cannot justify the costs.

Option 2: Partnering with an existing PayFac

If you are a SaaS provider, you have the option of partnering with an existing PayFac and offering payments to your customers without the rigmarole of building your own payments infrastructure from scratch.

With this model, your operational costs, set up costs, and other requirements like licensing fees and legal advice are all significantly lowered, as you are basically leveraging a company that has already done all of this for you.

You may need to invest in extra in-house resources like customer support and/or developers, however you can generally get started with an integrated solution with minimal investment on your side.

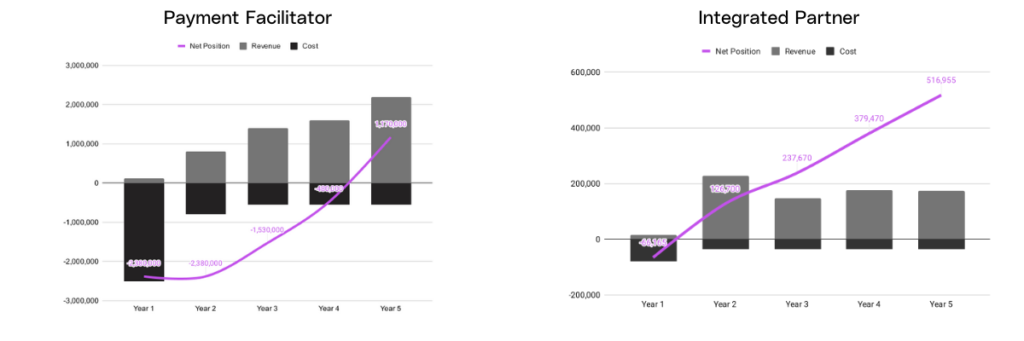

As an example, here is a comparison of what you might see if you chose an integrated payments partnership compared to investing in building your own PayFac.

Using rough estimates based on the above costs, and what our clients can generally expect to see with integrated payments, you can get an idea of what sort of ROI you can expect from each option.

Integrated payments are gaining significant traction in the United States and are quickly becoming more popular in Australia. Its popularity lies in the ability to control your customer experience and customise your solution, without having to heavily invest in building a payments solution.

In terms of revenue generation, you share the profit per transaction with your integrated partner. This allows you to still generate revenue from payments, without a significant investment to get started and is therefore highly suited to SaaS providers who want to get started with payments without the heavy upfront investment required to become a PayFac.

This can also be a good option to help you get on your feet, and when/if you scale enough to warrant becoming your own PayFac, you will have some of the experience and insights you need to do it at the right time, therefore expediting the process and minimising wasted resources.

Option 3: Becoming a referrer for an existing PayFac

Another option to generate a profit from payments is to consider becoming a referral partner for an existing payment facilitator.

An existing PayFac will generally give you a small fee or small % per transaction for merchants you have referred to their platform. Whilst there are no upfront costs generally associated with this model, the time it takes to generate a significant return on investment can make this model hard to justify.

It doesn’t involve any in-house development or staffing to get started, however you will need to train yourself or another team member to be able to sell the solutions to actually see any success with this model.

It’s worth weighing up the resources required to make the sale to see if the fee you are receiving is worth the time invested.

For a full breakdown of costs, benefits and what to consider when choosing a payments infrastructure, download our free SaaS Payments 101 eBook.