USE CASE

Reducing Debtor Days and Boosting Cash Flow

The challenge

One of your largest software clients, an urban planning firm that offers a range of services, was struggling with late and missed payments and slow settlements. Cash flow was constantly tight, and people in the firm’s finance and accounting teams were burdened with manual administration tasks and debtor follow-up. Further, with payments predominantly processed via EFT, settlement times were slow, and payment errors were common. The firm needed to address its invoicing and payment challenges with one streamlined solution. After doing a little digging, you discover this is a common problem faced by your users.

The solution

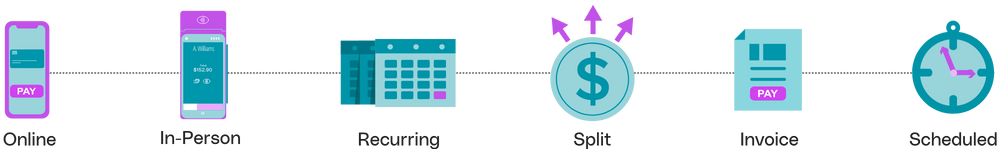

By integrating Payrix into your platform you are able to provide full omni-channel support for all the payment types your users need, whilst also generating a revenue margin on every transaction. With embedded payments, your ERP, accounting and/or practice management platform can streamline the day-to-day management of payments for your users, and as a result, your users are happier than ever before. With each transaction generating a profit for you, your business has experienced some pretty impressive growth too!

You don’t need to worry about investing extensive resources to make it work, either. With a dedicated partner portal and digital forms, we manage the onboarding process so you can focus on doing what you love. With the help of your new payment features, your clients can spend more time doing the work they love too, and less time chasing late payments.

Get a tour today