Key findings

- SaaS companies are growing revenue upon embedded financial services

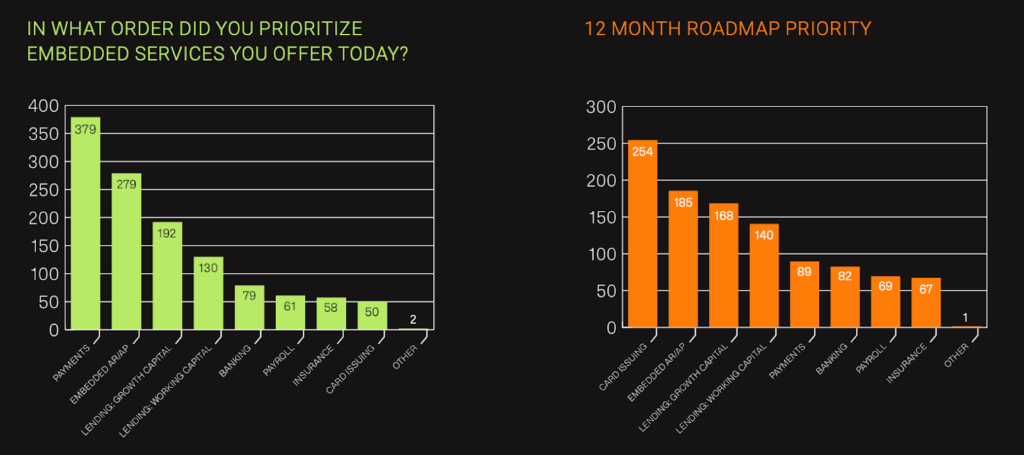

- The majority of survey respondents offer three categories of fintech products already

- Payments and lending are most embedded, as leaders eye card and banking offerings

Software companies are embedding financial services into their platforms to drive an average revenue increase of more than 40% per product built, according to a major new report co-produced by Payrix in partnership with several other leading fintech platforms.

The 2023 Embedded Finance Survey Report is the result of 1600 responses from global SaaS executives, collected in early 2023. The findings show 98% of respondents across several software verticals plan to launch (or improve) an embedded finance product in the next year, across payments, lending, payroll, accounting, and banking services.

Want a quick visual?

Embedded finance in focus

Embedded finance refers to the integration of financial services within non-financial platforms, such as software applications. This integration allows SaaS companies to offer a range of fintech products seamlessly to their customers, expanding beyond their core subscription-based revenue models. Software companies harness embedded fintech to provide:

- Funding for operational expenses, expansion plans, and revenue diversification

- National and international monetary transactions through digital channels

- Accounts receivable (AR) and payable (AP) for effective cash flow

- Risk assessments and insurance policies for potential losses

- Employee compensation, taxes, and benefits

- Payment cards for customers or employees

- Plus deposits, loans, and investments

Lending and payments — including AR and AP — are the embedded finance categories most likely to be offered by software companies right now, according to the report.

The top embedded services

The majority of survey respondents reported offering three categories of fintech products, with plans to develop products in two to three further categories over the next year. B2B SaaS platforms are even more ambitious. They are offering an average of three to four fintech product categories, and intend to expand into three to four more in the coming year.

Payments: the central pillar of SaaS revenue

When it comes to payments, the report makes it clear it’s the top priority across all industries, except for B2B and companies with more than $100 million in revenue. Embedded payments enable SaaS providers to accept customer payments without leaving their website.

In turn, this helps businesses to increase conversion rates and customer loyalty. Payment services can also drive billing, invoicing, and revenue recognition — making them a central pillar of the embedded finance ecosystem.

Why SaaS businesses embed payments

Revenue growth (22%) and seamless user experiences (43%) were the top factors that influenced software executives to embed payments on their platforms, followed by:

- better ability to handle customer payment requests

- an increase in customer stickiness (eg less churn)

- feature ‘parity’ with software competitors

In fact, exactly half of the respondents reported 30-49% of their customers have already adopted embedded payment solutions. The data show payments generate a significant portion of the average revenue per customer. Some software companies have even been able to achieve revenue percentages falling in the 20-49% ACV range, suggesting added payment capabilities may remain a lucrative business strategy for SaaS providers in the years ahead.

What vertical software leaders say

SaaS leaders see it this way, too. “Embedded payments are fuel for the rest of the business. We’ve had 40% growth in the last couple of years from payments,” a dance studio management software executive told the report.

“One of our hallmarks is providing a fully integrated and consistent user experience. Embedded payments follow that principle in that all the functions we provide are built on the same technology for consistency,” an education management software executive told the report.

Embedded accounts receivables (AR) and accounts payables (AP) proved to be highly valued by SaaS providers and customers alike too. Embedded AR and AP products help businesses and their finance teams to:

- reduce manual data entry

- minimize accounting errors

- improve cash flow management

- and increase finance department efficiency

When it came to identifying the drivers of embedded AR and AP adoption, software executives again cited revenue growth. More than 50% of respondents reported embedded AR and AP adoption rates of 30-49% among their customer base.

Full steam ahead for future-ready software

The report reveals goals for embedded finance extend well beyond payments. Many software companies are actively working on solutions in growth capital and working capital, virtual bank accounts, and payroll integration covering salaries, benefits, and related tax responsibilities.

Clearly, SaaS providers are seizing new capabilities to generate additional revenue beyond subscriptions held by customers and merchants. As a software executive mentioned above, embedded payments are ‘fuel’ for the rest of their business. As SaaS providers continue to invest in and enhance their embedded finance products, watch out for increased adoption and revenue growth in the very near future.